Yes, you can get a student loan towards your tuition fees for an online degree and several other types of undergraduate course.

To receive a tuition fees loan depends on the following four criteria –

The type of course

The university or college you want to study with

Your nationality or residency status

If you have already taken a university-level course

A Tuition Fees Loan is not based on household income, and there is no upper age limit to access this form of funding.

To understand if you qualify, what’s available, and how to apply, read on!

Tuition Fees Loan Key Facts

Types of Online, Distance Learning Courses That Qualify

Full-time and part-time courses at Level 4, 5 and 6 and three types of level 7 course*

*You can use a tuition fees loan for three types of postgraduate course.

How Much Can You Borrow?

- The maximum for part-time study is

£6,935 in an academic year. - The maximum for full-time study is

£9,250 in an academic year.

How Do You Pay It Back?

You repay 9% of earnings over £25,000 after you have graduated.

Student Finance and Student Loans Explained

What Is the Difference Between the Student Loan Company (SLC) and Student Finance England (SFE)?

In the UK, government student loans are managed by two separate companies. Student Finance and the Student Loans Company.

Student Finance process loan applications, decide the amount of funding each individual can get and pays the tuition loan directly to the university. In contrast, The Student Loans Company manages the government’s loan book and repayments. They keep track of all the amounts owed, repayments and interest charged to each student.

Student Finance by UK Region

This guide’s primary focus is on Student Finance England and applies to students living in England.

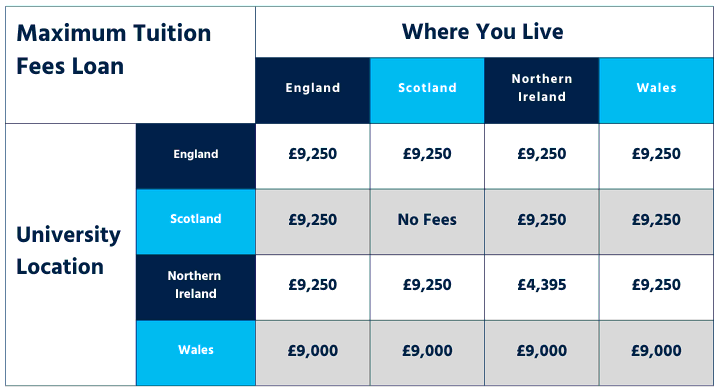

Depending on where you live and where you plan to study, the cost of the tuition fee can vary- from free in Scotland, £4,395 in Northern Ireland and £9,000 in Wales.

You apply to the region you currently live in, not the region where the university is based.

Student Finance Northern Ireland

Which Online Degrees and Certificates Qualify for Undergraduate Student Loans?

The qualifications listed below can be taken online and qualify for tuition fee loans.

BA, BSc or BEd- First Undergraduate Degree

FD- Foundation Degree

CertHE- Certificate of Higher Education

DipHE- Diploma of Higher Education

HNC – Higher National Certificate

HND – Higher National Diploma

ITT – Initial Teacher Training course

Integrated Master’s Degree

PGCE- Postgraduate Certificate in Education

Pre-registration Postgraduate Healthcare Course

Level 4 or 5 courses with Higher Technical Qualification Approval

Confusingly, some of the certificates that qualify for undergraduate student loans are postgraduate certificates. If you plan to enrol on Initial Teacher Training, a PGCE, a Pre-registration Postgraduate Healthcare course or an Integrated Master’s Degree, you need to use an undergraduate student loan and not a postgraduate Master’s Loan.

How Does Tuition Fee Loan Work?

A Tuition Fees Loan is a government-funded scheme that covers the costs of course. Student Finance England make the payments directly to your university or education provider. You only make repayments once you earn over a set amount after graduating.

Part-Time, Online Study Eligibility for Tuition Fee Loans

Online students fall under the same criteria as on-campus, part-time students.

The rule to be able to access a student loan with part-time study is-

Students must complete the course within a maximum of 4 times the duration it would take if they studied full-time.

For example,

A three-year bachelor’s degree consists of 360 credits, and each year of full-time study is made up of 120 credits. To qualify for the student loan, a part-time student must complete a minimum of 30 credits each year.

This means that if you use a student loan to take an online top-up degree (one year full-time), you have four years to complete the course and a maximum of 12 years to complete a full bachelor’s degree.

How Much Do You Get From a Tuition Fee Loan?

The maximum tuition loan available depends on where you live in the UK and where your university is based.

Can You Get a Maintenance Grant for an Online Degree?

Maintenance Grants are only available to online students if they cannot attend campus due to a disability.

Tuition Fees Loans can only be used to help with course fees and cannot be used to help with living costs while you are studying.

What Support Is Available If You Are Unable to Attend On-Campus Courses?

If you are taking an online degree because you cannot attend campus, you may be eligible for a maintenance loan and other support. The links below are a good place to start your research. We also recommend visiting the student finance website and contacting them directly to discuss your situation and the options available, as each individual’s situation is unique.

Contacting Student Finance Directly

Disabled Students’ Allowance (DSA)

How Much Do You Pay Back?

You only pay back a percentage of your earnings over the current threshold of £25,000. Any money you earn over that amount is liable for student loan repayments which are set at 9%.

So, for example, if you earn £26,000 in a year after graduating, you will repay the following.

Total earnings- £26,000

Earnings over the repayment threshold- £1,000

Student Loan repayment calculation- 9% of £1,000

Total repayable for the year- £90

Monthly deduction from Salary- (£90/12) £7.50

When Do You Start Making Repayments?

All the time you are studying, you do not make any repayments. You only start to make repayments the April following your graduation.

For example, if you finish your course in July 2023, repayments start in April 2024. Additionally, you only start making payments once you earn over a set amount. The current earnings threshold for students starting in 2023 is £25,000 a year in England.

When Should I Apply for a Tuition Fee Loan?

You should apply a minimum of six weeks before your course starts. Six weeks is the time that Student Fiance aims to process applications. However, the process can take longer if they need clarification from you or you are applying during a busy period.

You do not need a confirmed place on your chosen course to start your student finance application. You can apply to Student Finance at the same time or even before you apply for your course.

Applying After Your Course Starts

You can apply for a tuition fee loan up to 9 months after your course starts. The cut-off date is calculated from the first day of the academic year that the course begins.

There are four academic year start dates depending on the day you start your course.

The first day of the academic year is –

1st September if your course starts between 1st August and 31st December.

1st January if your course starts between the 1st January and 31st March.

1st April if your course starts between the 1st April and 30th June.

1st July if your course starts between the 1st July and 31st July.

How to Apply for a Tuitions Fees Loan?

Applying for a tuition fee loan is relatively straightforward and can be done entirely online or via a paper-based application. You can get more details and apply using the link below.

Apply online for Student Finance

Student Finance for an Online Degree FAQ

What Is a Recognised Degree-Awarding Education Provider?

Only degrees awarded by recognised bodies are eligible for a student loan. We have a complete list of recognised universities. You can also check the Office for Students Register for colleges, private education providers and universities.

Certificates Awarded by Third Parties

Some colleges and private education providers offer degrees and certificates awarded by a university or an accreditation body. This works by the university providing the syllabus and learning goals and then independently grading the assessments that the students at the college produce.

Some universities and colleges offering degrees and certificates are recognised by student finance, and you can use a tuition fee loan. However, other private education providers that provide accredited courses are not eligible for Tuition Fees Loan.

If in any doubt, ask the education provider to confirm that you can use a student loan when you enquire about the course.

Nationality or Residency Status Required for Student Finance

To be eligible for a student loan, you need to –

- Be a UK national or Irish citizen, have settled status under the EU Settlement Scheme, or have indefinite leave to remain in the UK- meaning there are no restrictions on how long you can stay in the UK.

- Normally live in the UK.

- Living in the UK, the Channel Islands or the Isle of Man for three consecutive years before the first day of the academic year that your course starts- see above.

The rules around nationality and residency status are complex. You can see all the rules and exceptions on the government Student Finance eligibility page.

What Is the Interest Rate on a Student Loan?

For all courses starting after December 2022, the maximum interest rate charged is 7.3%. The interest rate you are charged does not impact the amount of your monthly repayments. But it does impact the total amount you are liable to pay back.

When Does Interest Start on a Student Loan?

Interest is added to your account from the day Student Finance makes the first payment to your university or college. Interest is added to your account each month until you either repay the loan in total or it is cancelled after 30 years.

Can You Get a Student Loan for a Second Degree?

Yes, it is possible to access Student Finance to take a second degree from a limited set of subjects. The support available is called a Second Degree Loan.

You might be eligible for a tuition fee loan to pursue a second online degree, part-time, in a new subject, such as bioscience, engineering, computing, or mathematics.

These are the subjects currently available for a second-degree loan.

Agriculture And Related Subjects

Architecture (If It’s A March Riba Part 2 Course)

Biological Sciences

Computer Science

Mathematical Sciences

Medicine And Allied Subjects

Physical Sciences

Technologies

Courses Leading to Qualification as a Veterinary Surgeon

As everyone’s situation is unique, it’s best to speak with Student Finance England to review your situation and understand your options for a Second Degree Loan.

Which Level 7 Courses Qualify for an Undergraduate Student Loan?

The following course titles can be funded via an undergraduate Tuition Fees Loan when taken part-time and/or online, even though they are postgraduate certificate programmes.

Postgraduate Certificate of Education (PGCE)

Integrated master’s

Initial Teacher Training (ITT)

Pre-registration postgraduate healthcare course

Can You Use a Student Loan for an Online Top-Up Degree?

Yes, it is possible to use a Tuition Fees Loan to take an online top-up degree part-time or full-time as long as the education provider is recognised by, and you meet the eligibility criteria for, Student Finance.

What Happens to a Student Loan If You Do Not Finish the Course?

If you leave your course early, you must inform student finance straight away. Any tuition fees already paid to the education provider will need to be repaid under the same rules as if you had graduated. Repayments start the following April only if you are earning over a certain amount.

How Long Does It Take to Get a Tuition Loan?

Student Finance advises that processing an application can take up to 6 weeks. It can take longer if they have to ask you for clarification or extra documentation. We recommend applying sooner rather than later.

Can You Get Student Loans for Full Tuition?

Yes, you can get a Tuition Fees Loan for the total tuition amount as long as the fees charged by the education provider are below the maximum allowable amount.