If you’re a UK resident, you can apply for a type of student loan to help cover the costs of an Online Master’s Degree. A Master’s Loan can be used for tuition fees, study materials, or living expenses while studying online. Unlike undergraduate student finance, which only covers tuition fees, a Master’s Loan provides more flexibility in how the funds can be used.

Because a Master’s Loan has favourable interest and repayment conditions, we recommend taking advantage of this option if you are eligible. It is the best type of borrowing to help with your course fees and has minimal risk compared to a commercial loan.

Having said that, as with any financial decision, before you agree to a Master’s Loan, make sure you understand what you are committing to and that you can afford the repayments once you finish your online study.

What Exactly Is a Master’s Loan?

A Master’s Loan is the latest name of the UK government’s funding for online postgraduate students. It replaced the previous system of Professional and Career Development Loans.

With a Master’s Loan, you can borrow a maximum of £12,471 for an online master’s degree starting after 1st August 2024. The loan is paid directly into your bank account in three instalments per year by Student Finance England (SFE). You can use the money in any way you want to support your study. You do not need to show how you spend the funds.

You only start repaying the loan once you have graduated, and the repayments are taken directly from your wages only when you earn over £21,000 in the UK and just over approximately £25,000 in Scotland.

Who Are Student Finance England (SFE)?

Student Finance England deals with allocating government loans for higher education to applicants. They manage the distribution of government-backed funds and transfer the funds to either individuals, in the case of a postgraduate loan or institutions for undergraduate loans. SFE is a collaboration between the Student Loans Company and the Department for Education.

Who Are the Student Loans Company?

The Student Loans Company (SLC) is a not-for-profit organisation that manages the student loan book for the government. They are responsible for all student loan repayments via payroll or self-assessment tax returns.

How Much Can You Get from a Postgraduate Master’s Loan?

For courses starting after 1 August 2024, you can request a loan of up to £12,471. You can choose the sum you borrow up to the maximum. If you decide to borrow less than the maximum available, you can increase the amount if needed while studying.

The loan available to you is not related to your, or your family’s, income or the tuition fees set by the university. You can apply for the same maximum amount for full-time and part-time study either on-campus or via distance learning and online.

How Do You Receive a Postgraduate Student Loan?

Student Finance England pays the money directly into your bank account. Receiving the funds direct differs from undergraduate student loans, which are paid directly to the university.

When Do You Get Paid?

Payments are spread evenly throughout your study. You get paid in three instalments for each year of study. You receive the first instalment when Student Finance has confirmation from the university that you have started the course. The remaining two instalments are spread evenly over the year.

One-year payment schedule example

- Start of course, 33%

- Payment 2 33%

- Payment 3 34%

If you take an online master’s part-time over two years, you will receive six payments spread evenly over the two years.

Two-year payment schedule example

- Start of year 1, 16%

- Payment 2 16%

- Payment 3 18%

- Start of year 2, 16%

- Payment 2 16%

- Payment 3 18%

Who Can Get a Postgraduate Loan?

To qualify, you must be under 60 and have the right to live in the UK. Student Finance checks your age, nationality, or residency status when you apply.

Age Requirement

To be eligible for a Master’s Loan, you need to be under 60 on the first day of the academic year that the course starts.

Depending on the course start date, Student Finance will use one of the four dates below as the cut-off point to assess your age.

- 1st September if your course starts between 1st August and 31st December.

- 1st January if your course starts between the 1st January and 31st March.

- 1st April if your course starts between the 1st April and 30th June.

- 1st July if your course starts between the 1st July and 31st July.

Nationality or Residency Status

To qualify for the loan, you need to be

- A UK national or Irish citizen or have settled status under the EU Settlement Scheme or have indefinite leave to remain in the UK- meaning there are no restrictions on how long you can stay in the UK.

- Normally live in England.

- Living in the UK, the Channel Islands or the Isle of Man for three consecutive years before the first day of the academic year that your course starts- see above.

The rules for settled status and some of the exemptions are complex. You can find the complete list of residence rules on the Master’s Loan page on the government website.

Residency Rules for Studying an Online Master’s Degree

You can take holidays and travel outside the UK, but you need to be a resident in the UK for the duration of your study.

If you are a UK National, EU national or have settled status, to be eligible for the loan when you take an online master’s degree, you need to be living in the UK for the duration of your course from the first day of the academic year that your course starts.

The loan is not available to you if you are a UK ex-pat living outside the UK during your study.

Types of Online Postgraduate Courses Are Eligible for the Master’s Loan

Only complete master’s degrees from recognised UK Universities are eligible for the postgraduate student loan. You need to be aware that there are time limits on how long the course can take if you study part-time. The Master’s Loan is available for taught or research master’s degrees.

Complete Master’s Degree Criteria

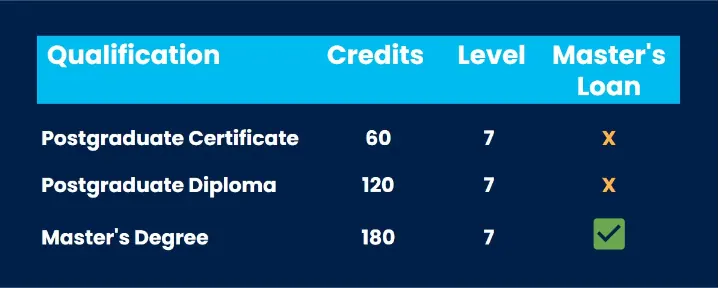

To count as a full master’s degree, the course must have 180 credits at level 7.

Course Intensity via Part-Time Study

The online master’s can be;

- Full-time, lasting one or two academic years.

- Part-time, at 50% intensity to its full-time version- if the course is one year full-time, the loan is only eligible when you complete the course over two years part-time.

- Part-time for up to three years if there is no full-time version of the course.

Online and on-campus postgraduate certificates and diplomas are not eligible for a postgraduate Master’s Loan.

Recognised Awarding Body

The education provider must be an eligible college, private training provider or university in the UK with degree-awarding powers.

When Do You Pay a Postgraduate Student Loan Back?

You are liable for student loan repayments in the April following your master’s graduation if you earn over a set amount. For example, if you graduated in May 2025, you would start making payments in April 2026.

How Are Repayments Made?

If you are employed, your repayments are deducted by payroll, similar to tax and NI. You do not need to do anything. If you are self-employed, you will need to make repayments in the same way as tax via the self-assessment process.

At any point, you can make a voluntary repayment without penalty. This flexibility means that taking a Master’s Loan can be prudent even if you have savings that would cover the tuition fees.

For example, if you are using a master’s degree to make a career change, keeping your savings intact can provide a helpful financial buffer as you change jobs. Once you are stable in your new role, you can either carry on making regular repayments or use your savings to clear your postgraduate loan completely.

How Much Do You Need to Earn to Start Making Repayments?

- In England, you must earn £21,000 a year (£1 473 a month) before you begin to repay the loan. Once you earn over that amount, you repay 6% of your salary over £21,000.

- In Scotland, the earning threshold is £25,375 a year, but the repayment amount is 9% on income over the threshold.

- In Northern Ireland, the earning threshold is £20,195, and repayments are set at 9% of earnings over that amount.

If your earnings drop below the threshold, the payments stop. You only start repayments when your earnings increase over the threshold. This flexibility is a key benefit of this type of loan.

How Much Is the Interest on Postgraduate Student Loans?

As a rule, the interest rate for student loans is set at the RPI plus 3%. However, in response to the inflation spike in 2022/23, the UK Government has capped the interest at 7.3%. The current interest rate cap is 8%.

Master’s Loan FAQ

How do you apply for a Master’s Loan?

You apply online or download the complete application form and guide. The online application is straightforward. You will be asked to provide your personal details, proof of identity, information about your background, and the course and university to which you are applying.

You must state the course you want to join when you apply for the loan. The government website has complete information about eligibility and the application process.

How long does it take to get confirmation from Student Finance about your Master’s Loan?

Student Finance England (SFE) try to process all application in 4 to 6 weeks. However, applications may take longer if they need to request clarifications or extra information.

We recommend that you apply for the Master’s Loan at least three months before your course starts in case of any delays.

You can apply for your online master’s before receiving your funding confirmation from Student Finance England. It is common to complete your application and hold an offer of a place before applying to student finance. Many prospective postgraduate students apply to several universities before selecting the one they eventually enrol on.

Can you get a maintenance loan for an online master’s degree?

No maintenance loans are available for Master’s degree students studying either on-campus or online.

Can the government change the repayment terms of your Master’s Loan?

Yes, this is a possibility. The government can change the terms of the loan repayments. Changes by the government to the terms are the only fundamental risk/ uncertainty involved with student loans. However, it may not always be a negative change, and public opinion would not look kindly on anything that felt unfair.

For example, faced with a spike in inflation, the expected interest rate on student loan debt was projected to hit 12%. However, the government has stepped in and capped interest at 7.3%.

Can a Master’s Loan impact child benefits and tax credits?

Getting a loan to cover your tuition fees does not usually impact child benefit and tax credits. However, the benefits system is complex, and you should get advice before you commit to a student loan. TurnToUs has more detailed information and advice regarding student finance and its impact on benefits.

What happens to a Master’s Loan if you do not finish the course?

You need to inform student finance that you have left the course. If you receive a payment after the date you left, you will be asked to repay it immediately. However, the amounts you received while you were still studying on the course are repaid in the same way as a complete loan.

If you are earning over the repayment threshold, deductions will start in April following your course withdrawal. The payments are taken at the same percentage as if you completed your online Master’s degree- see above.

Can you get a student loan for an online master’s?

Yes, the government-funded Master’s Loan is available for Online Master’s degrees from recognised UK universities.

Does student finance pay for distance learning master’s degrees?

Student Finance does provide loans for full Master’s degrees from UK universities. However, they offer a set maximum amount that may not be enough to cover the entire tuition fee set by some universities.

Can you get a student loan for postgraduate study?

You can only get a postgraduate student loan for a complete master’s course at 180 credits. The course can be on-campus, online or distance learning, part-time or full-time.

You cannot get a postgraduate loan for a PgCert (60 credits) or a PgDip (120 credits).

Can you get a student loan for a second master’s?

No, you can only get a student loan for postgraduate study once. If you have used a UK Government postgraduate loan scheme to fund a first master’s degree, you cannot get a second loan. This applies even if you did not complete your study but still used a postgraduate loan in the past.

Is there a deadline to apply for a master’s/postgraduate loan?

There are no deadlines for applying before you start studying. In fact, you can apply up to 9 months after the first day of the academic year that your course started. The first day of the academic year depends on the exact start date of the course- See table above.

We recommend that you apply for your Master’s Loan at least three months before your course starts if you are relying on postgraduate student finance to cover your fees and do not plan to use your savings to cover the tuition fees.